Content

The world of accounting is undergoing a seismic shift as we move further into the digital age. In 2026, businesses and accounting professionals will face a landscape shaped by emerging technologies, regulatory changes, and evolving client expectations. These challenges demand a proactive approach to stay competitive and compliant in a fast-paced market.

From the rise of artificial intelligence and blockchain to the increasing focus on sustainability and ESG reporting, the accounting profession is at a pivotal crossroads. Adapting to these trends isn’t just a choice—it’s a necessity for firms and professionals aiming to thrive.

This blog explores 15 key accounting trends that will define 2026, offering insights into the tools, strategies, and skills needed to navigate this complex environment. Whether you're an experienced accountant or a business leader, understanding these trends will empower you to anticipate change, embrace innovation, and achieve long-term success.

2026's Game-Changing Accounting Trends You Need to Know

So, let us look at the latest accounting trends that you must take note of:

1. Increased Use of Data Security

Accounting firms and their clients share more information electronically; they must protect themselves from cyber threats and other data security problems. One way to do this is to ensure their employees know data security.

Cloud-based software is a cheap and scalable way to store data online in a secure way. This makes it easier for accountants to get to work on the go or at home.

Accounting firms should also set up systems that require two forms of authentication so that only authorized users can get sensitive information because accountants and clients share so much confidential financial information.

Focusing on data security will help organizations protect their customers' most valuable asset, their financial information.

2. Accounting in the Cloud

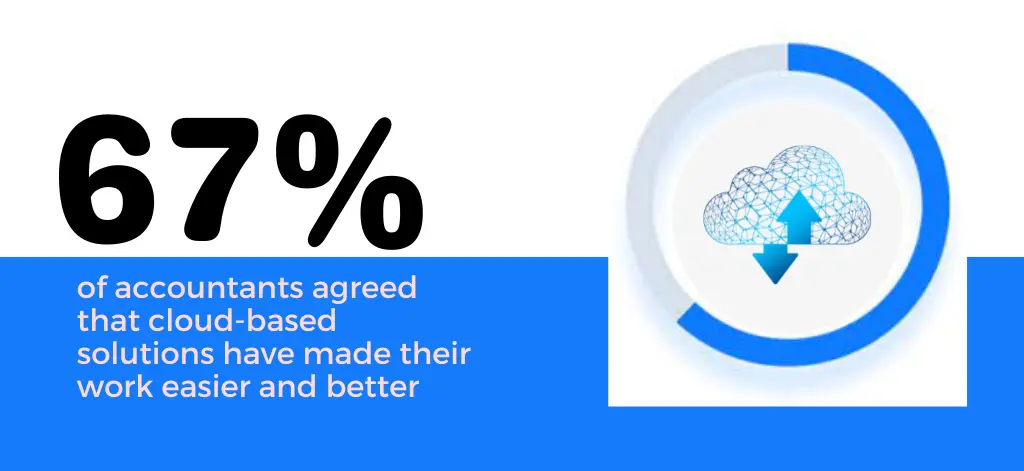

The cloud and Accounting are now two things that most businesses can only do. Accounting systems hosted on the cloud have made it easy for many businesses to access their digitally hosted system anytime and anywhere. There are many benefits of adopting cloud technology. Even the accountants agreed that cloud-based software is the need of the hour.

"The Practice of Now" by Sage found that 67% of accountants agreed that cloud-based solutions have made their work easier and better.

In another report by Accounting Today, 58% of organizations noticed and accepted the benefits of moving to the cloud and are now using cloud-based accounting systems. This proves the importance of the cloud in accounting streams.

In recent years, many organizations have tried their best to make this shift but encountered challenges in data security, integration complexities, and legacy system compatibility. A few companies, bigger ones, though, managed to make the transition smoothly.

In the upcoming years, moving to the cloud will become imperative for most businesses seeking process flexibility. However, this time, the move will be marked by a determined effort to overcome the challenges of migrating to cloud environments. Businesses will strive to develop a more mature approach to cloud migrations based on what they have learned from their previous experience. For instance, non-core functions should be prioritized to check suitability before embarking on complete accounting process migration.

3. Increased Use of Financial Software

In this age of modernization and digitization, there is no doubt that the need for good financial software is growing. As a result, the market for business accounting software is expected to grow 6% per year from 2020 to 2026.

Technology is more important than ever if you want to keep up with the market and stay ahead of the competition. For example, SMEs can look into accounting and finance software that can help them right away with things like managing cash and spending, keeping track of billing and invoicing, and processing payroll.

Using accounting software increases accuracy by reducing errors. Software applications with advanced technology help generate financial analysis reports in a single click, assisting in effective decision-making. In addition, all the data can be backed up in cloud storage, making it easier to recover during losses. Most F&A partners rely on software to increase productivity and accuracy.

4. Offshore Staffing with Remote Workplace

Finding the right people in finance and accounting is getting harder and harder. Because of this, it is even more important for businesses to expand how they search for and hire candidates.

A poll was done that more than 80% of CPA firms plan to let employees start working from home even after the pandemic. Before, this wasn't possible. As technology improves, accounting systems emerge, and accountants who work from home can do just as well as those who work in offices.

Look at the below stats:

The 10th Annual Flex Jobs Survey, done from July to August 2021, found that 58% of respondents want to work full-time from home after the pandemic, while 39% want a hybrid work environment.

A poll was done that found that more than 80% of CPA firms plan to let employees start working from home even after the pandemic. Before, this wasn't possible. As technology improves, accounting systems emerge, and accountants who work from home can do just as well as those who work in offices.

And a classic example that comes to mind is a setting where people work from home. Most of us will agree that the costs have been cut by embracing remote work and digital accounting trends and techniques. Plus, it has made the whole progression better.

5. AI for Accounting

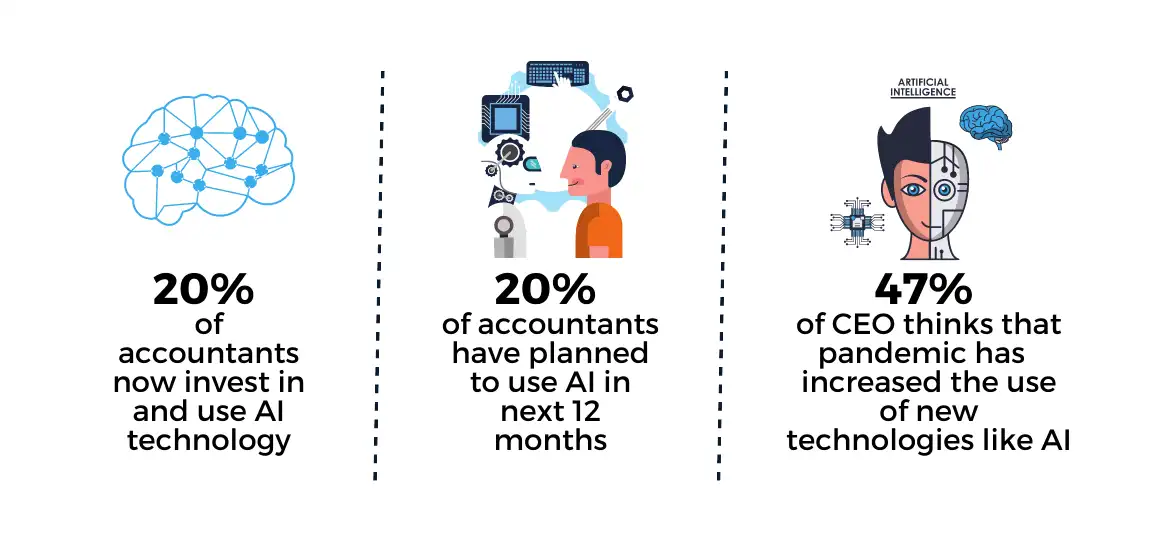

Accountants and Chief Information Officers (CIOs) agree that artificial intelligence software is one of the new technologies that will shape the industry's future.

A survey by Harvey Nash/KPMG found that 20% of accountants now invest in and use AI technology. Another 20% said they planned to use AI within the next 12 months (Sage,2020).

On the other hand, 47% of CIOs think that the COVID-19 pandemic has sped up digital transformation and increased the use of new technologies like AI, machine learning, blockchain, and automation.

AI runs mostly on data, so businesses need to get good data. This will enable businesses to get accurate business intelligence, giving them an edge over their competitors.

Businesses struggled to adopt AI for two primary reasons. Complex implementation processes and the need for substantial capital investment. As the need for these two technologies will be paramount in the upcoming years, businesses will look for leaner ways to adopt them seamlessly.

In the future, the move to adopt automation and AI in driving finance and accounting processes will grow stronger. However, to make the most of their drive, the approach is expected to be more strategic. It will begin by identifying processes ripe for automation, such as routine data entry and reconciliation. It will involve adopting a phased approach, starting with less complex functions and gradually expanding. Even small businesses are expected to invest in advanced AI technologies to align with specific financial tasks.

6. Implementing Blockchain Technology

Blockchain technology is a distributed ledger that makes transactions safe and impossible to change. As a result, it will probably change how many businesses work.

Blockchain technology is already changing finance and accounting, making reconciling and maintaining ledgers cheaper. In addition, this technology will likely be used for audit trails, payments, and billing, reducing the need for banks and auditors to act as middlemen.

However, only a few businesses have seriously considered this tech in recent times. Therefore, in the coming years, the adoption of blockchain technology in finance and accounting will significantly rise. The primary reason would be the need to foster trust and enable secure cross-border transactions. Even small businesses will be no exception to embracing blockchain.

So, as the business appears differently, accountants need to know how technology works.

7. Real-time Payments

The need for real-time payment solutions to enhance transaction speed, reduce settlement times, and fulfill the demands of an increasingly dynamic market was there in 2024.

Not all businesses that embarked on adopting real-time payments in the past succeeded. They encountered obstacles such as outdated infrastructure and regulatory complexities and had to counter unconventional ones like shifts in mindsets and resistance to change.

Looking ahead into the future, a majority of businesses relying on traditional payment methods will make a shift to real-time payment. Likewise, businesses that couldn’t pull off the change in 2024 will go the whole hog by adopting a holistic approach that would primarily integrate technology, education, and strategic planning.

8. Increased Use of Data Analytics

In today's fast-paced business world, trying new ways in finance and accounting is important. With the rise of data analytics, accountants are asked to do more than report on finances.

Business owners want to know how they can make more money, save, and give better service to their customers. As a result, many accountants also act as advisors and consultants in these areas.

Data analytics leads to better and more efficient systems, which saves time and money. Accountants can better understand the process and suggest ways to cut costs and save time if they can look at financial results quickly.

Accountants can also use predictive data analytics to set prices and make better forecasts that help business owners know what to expect in the future. They must become more strategic and move toward projects to help their businesses run better and make more money.

For years, businesses faced hurdles in integrating advanced data analytics into their operations due to a lack of skilled professionals and outdated infrastructure. Security concerns and resistance to change hindered the seamless adoption of cutting-edge analytics tools, slowing the transition. Despite challenges, businesses that successfully embraced advanced data analytics in the past experienced enhanced decision-making capabilities, improved operational efficiency, and a competitive edge.

In the future, businesses that have not adopted analytics will take a full plunge to reap all the benefits of data analytics. Likewise, businesses that have already gone for the shift will opt for smoother integration through cloud-based platforms and integrate other advanced technologies. One such technology is enhanced AI capabilities to drive real-time insights for agile financial decision-making.

9. Social Media will become an Enabler

Accounting and social media may seem like strange partners, but networking is important to the success of almost every business. Even the most traditional people used social media to talk to potential clients post-pandemic. Likewise, social media sites help accounting firms build their reputations, get more people to visit their websites, and make new contacts. With social media, the accounting industry must catch up to the rest of the business world.

10. Taxes Can be Filed Online

If your finances could be better, you must spend much time on your tax calculations to ensure they are correct. However, you can automate your tax filing with online software and tools, keep track of your tax returns, and make bookkeeping much easier.

One can figure out how to use these apps on your own or with the help of an accountant. In either case, filing taxes online is a useful and easy way for small businesses and SMEs to get their taxes done. But, as with any technology solution, it's important to ensure that the person using these systems for a business knows how to use them properly and professionally. Hiring the solutions frees you from tax problems as they file your tax returns on time.

11. The Jobs of Accountants are Changing

The difference between finance and accounting has always overlapped, but as the accounting field becomes more focused on data analytics, more accountants are moving into advisory positions. In addition, accounting technology has improved, so accountants can give their clients more accurate information.

One way accountants can keep from being completely replaced by computers is by using the right technology to help businesses. Unlike other accounting tasks, making decisions will always be in the hands of experts and professionals.

12. Agile Accounting

Agile practices in software development are for implementing changes in software during development. Likewise, Agile Accounting is the process of adapting agile practices in accounting software to make changes in accounting at a rapid pace. Adapting to the changes on time and delivering effective accounting will increase customer satisfaction. It will be a marketing trend in 2026 to adopt agile accounting practices with accounting software.

Focusing on new trends in accounting and implementing technology will pave the way for advanced accounting for increased profits. The data flow between the stakeholders will be continuous through effective communication, which reduces flaws in accounting and thus increases productivity. Hiring the tasks will allow you to access agile accounting.

13. Advisory Solutions

The need for advisory solutions has increased significantly due to organizations' challenges. Experts' suggestions and recommendations on accounting practices and financial strategies effectively resolve the challenges. Organizations can improve their decision-making through analysis and future predictions. An Analysis of financial advisory and consulting from Spend Edge reveals the market value increase will be $21 billion.

Financial advisory helps improve the business through strategic decision-making and timely responses. You can secure your business from various pitfalls by hiring accounting advisory needs. It also helps businesses focus on core responsibilities rather than spending more time on financial activities.

14. Advanced Personalized Financial Services

The rise of personalized financial services as one of the finance trends stemmed from evolving consumer expectations for tailored experiences. Challenges in earlier years were centered around data privacy concerns, limited technological capabilities for personalized offerings, and regulatory constraints on data usage.

In the past, businesses grappled with balancing customization and privacy, striving to leverage customer data ethically while meeting stringent regulations. This led to a gradual but cautious integration of personalized services within the financial sector.

This proved invaluable for businesses, fostering stronger customer relationships, increased engagement, and bettered financial planning outcomes. Transitioning into the future, this trend will include a deeper integration of AI and machine learning. In the process, businesses can offer enhanced personalization strategies and more precise financial solutions.

15. Sustainability Reporting

In response to global environmental concerns, the finance industry witnessed the emergence of sustainability reporting. Businesses grappled with the need to align financial practices with environmental, social, and governance (ESG) criteria. Also, they struggled to strike a balance between profitability and responsible, sustainable practices.

Despite initial hurdles, the incorporation of sustainability reporting proved beneficial. In the upcoming years, businesses are poised to enhance transparency, build stakeholder trust, and capitalize on the growing investor interest in sustainable financial practices, marking a significant shift towards environmentally conscious finance.

Conclusion

Accounting has evolved significantly with advancements in technology, such as AI-powered analytics, cloud computing, and automated tools. These innovations streamline processes like bookkeeping, financial reporting, and tax management, enhancing accuracy and efficiency. However, managing accounting in-house remains complex due to regulatory compliance, dynamic financial landscapes, and the need for real-time reporting.

Outsourcing finance and accounting to a third-party provider ensures expert handling of these challenges while enabling businesses to focus on core operations. Invensis, a trusted partner in this domain, offers end-to-end finance and accounting services tailored to your needs. Leveraging cutting-edge software, we provide seamless accounts payable/receivable management, payroll processing, financial analysis, and more. Our solutions enhance accuracy, ensure compliance, and offer actionable insights. Contact us today to achieve financial efficiency, reduce operational costs, and focus on strategic growth.

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Optimize your store in 2026 with the best WooCommerce order management plugins. Automate order tracking, inventory, and customer service for success.

January 21, 2026

|

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

February 2, 2026

|

Services We Provide

Industries We Serve

.webp)