Back Office

Back OfficeSwitzerland BPO Market Size, Growth Trends & Future Outlook 2026

Content

The demand for high-quality, multilingual services, growing operational costs, and digital transformation are driving the continuous growth of the business process outsourcing (BPO) market in Switzerland. Switzerland offers strategic advantages despite being smaller than large offshore hubs, especially in regulated industries such as law, healthcare, and finance.

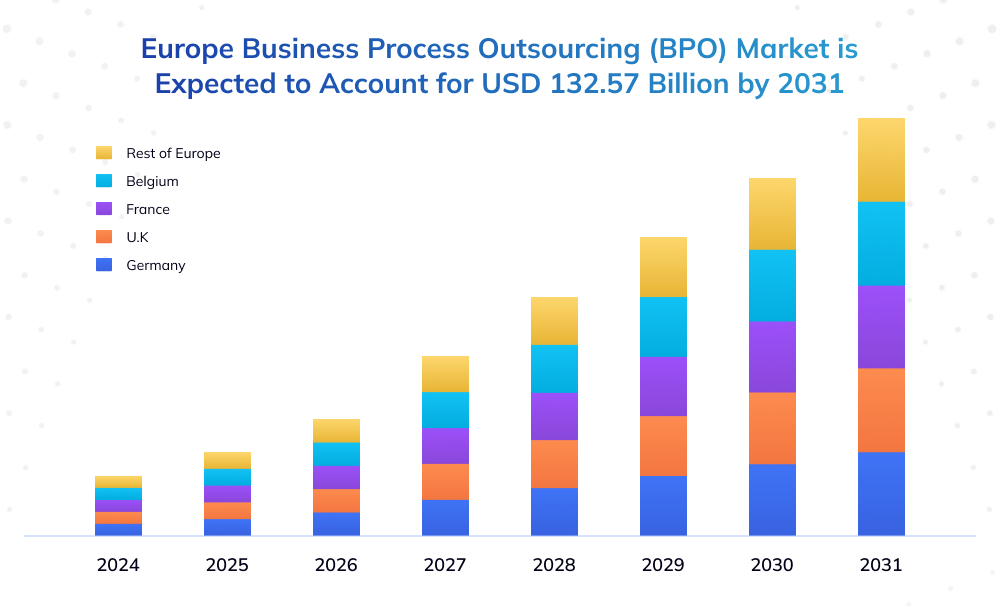

Swiss businesses are rapidly adopting BPO for increased efficiency, scalability, and innovation using artificial intelligence. In fact, Switzerland is well-positioned to increase its share of high-value outsourcing, as the European BPO market is projected to grow at a compound annual growth rate (CAGR) of more than 8% through 2032.

This blog examines the size, growth factors, major trends, obstacles, and prospects of Switzerland’s BPO market for 2026 and beyond.

Brief Overview of Switzerland’s BPO Market (2026)

In 2026, Switzerland’s BPO market is characterized by a stable level of maturity among major corporations and an increase in interest from SMEs.

Large corporations have traditionally led the demand for outsourced services. However, as digital platforms reduce hurdles, SMEs are increasingly adopting BPO services.

Switzerland’s business-friendly climate, stringent data protection regulations, and availability of highly qualified, multilingual talent benefit both large corporations and SMEs.

Large Enterprises

Large Swiss businesses have been early adopters of BPO, particularly in the banking, finance, insurance, pharmaceutical, and manufacturing industries. In 2026, these businesses are prioritizing outsourcing for various reasons:

- Outsourcing Scope: IT services, finance and accounting, customer service, human resources, and compliance operations

- Emphasis on Automation: To allow for scalability and speed, many are incorporating cloud-based platforms, AI, and RPA into their BPO relationships.

- Global Partnerships: By integrating local delivery with international best practices, these companies frequently collaborate with leading global BPO providers, including Invensis, Accenture, Capgemini, TCS, and IBM.

Small and Medium-sized Enterprises (SMEs)

In the Swiss BPO sector, small and medium-sized enterprises (SMEs) are emerging as a growing segment in 2026. Traditionally more conservative, these businesses are now increasingly turning to outsourcing due to more affordable digital BPO options like BPaaS that cater to lighter workloads. SMEs also have a better understanding of the benefits of outsourcing, including time savings, reduced hiring efforts, and digital enablement. Additionally, niche firms and regional providers now offer specialized services such as bookkeeping, virtual assistance, IT support, and digital marketing, making outsourcing more accessible and attractive to this segment.

Key BPO Service Segments Fueling Market Growth in Switzerland

.webp)

The BPO industry in Switzerland is expected to generate approximately US$2.94 billion by 2025 and grow at a 3.1% CAGR until 2030.

Both vertical industry solutions, such as BFSI, healthcare, manufacturing, retail, telecom, and the public sector, as well as horizontal service lines, like customer support, finance & accounting, HR, IT, and legal, are responsible for this consistent development.

The main factors driving the continuous growth of the Swiss BPO industry are these segments.

By Service Type

1. Customer support

Swiss BPO companies are going beyond conventional call centers by providing multilingual, round-the-clock, AI-powered phone, chat, and email assistance. In 2024, the nation’s call center business alone generated approximately €456 million, growing at a rate of around 5.9% per year. High expectations for security and quality are driving the performance of this market.

2. Finance & Accounting

Swiss businesses can reallocate internal resources to higher-value strategic projects by outsourcing financial functions, such as payroll, tax compliance, accounts payable and receivable, and financial reporting.

With more than 21% of revenue, the finance & accounting (F&A) segment led the global BPO market in 2024, highlighting its importance and balancing demand in Switzerland.

3. HR Services

Businesses are outsourcing payroll, benefits administration, hiring, and employee development due to various labor restrictions and increasing administrative complexity. Similar to the worldwide BPO trend, Switzerland has made significant investments in HR operations and talent acquisition.

4. IT Services

The IT services market in Switzerland is expected to reach US$7.59 billion by 2025, with a compound annual growth rate (CAGR) of 6.9%.

Cloud migration, app development and testing, cybersecurity, and DevOps are among the essential services for safeguarding digital transformation.

5. Legal Process Outsourcing

Switzerland’s stringent data protection rules and intricate regulatory framework are driving the country’s steady growth in legal process outsourcing (LPO). Contract management, regulatory compliance, intellectual property assistance, and due diligence are among the services that businesses are increasingly outsourcing.

A significant LPO-related sector, the Swiss regulatory affairs outsourcing market was estimated to be worth USD 42.4 million in 2023 and is expected to reach USD 67.7 million by 2030, growing at a 6.9% CAGR.

Switzerland is emerging as a top destination for high-end legal outsourcing services due to its multilingual legal expertise, robust infrastructure, and clients’ confidence in data privacy.

By Industry:

1. Banking, Financial Services & Insurance (BFSI)

The sector most responsible for Switzerland’s BPO demand is the BFSI sector. Fraud detection, KYC and compliance, loan processing, and other back-office tasks are among the essential services that can be outsourced.

Swiss businesses are utilizing BPO providers that deliver cloud-based platforms and AI-driven solutions to enhance accuracy, speed, and security in response to increasing regulatory demands. This gives efficiency a competitive edge in this highly regulated industry.

2. Healthcare

With sales expected to reach €1.156 billion in 2024 and expand at a 10.9% CAGR through 2029, Switzerland’s digital health sector is booming. The rapid digital transformation in healthcare delivery has led to a surge in demand for medical billing, patient administration, telehealth support, and claims processing.

3. Manufacturing

With the help of IoT and data insights, Swiss manufacturers are increasingly outsourcing technical assistance, production planning, and supply-chain analytics. In a cutthroat global marketplace, this strategy change enables businesses to reduce expenses, enhance productivity, and drive innovation.

4. Retail and eCommerce

The Swiss eServices market is anticipated to develop at a 7.0% CAGR through 2029, reaching USD $3.30 billion by 2026. Order processing, inventory control, and AI-powered multilingual customer support are among the key outsourcing requirements that have emerged from this spike, enabling retailers to deliver outstanding shopping experiences.

5. Telecom

Critical operations, including network monitoring, billing reconciliation, and technical support, continue to be outsourced by the telecom industry. To achieve the flexibility and scalability required in a rapidly evolving digital market, many providers are opting for cloud-based, as-a-service models.

6. The Public Sector

Swiss public agencies are now adopting outsourcing for back-office operations, administrative support, and digital citizen services, albeit with greater caution than the private sector. This aligns with the country’s Digital Switzerland Strategy 2026, which promotes safe and lawful digital governance.

Key Drivers and Trends Shaping the Swiss BPO Market (2026)

1. Rising Cost Pressure and Demand for Operational Efficiency

Strong cost dynamics affect Swiss enterprises, yet the BPO market helps strike a balance between cost-effectiveness and accuracy. Swiss companies spent about $583 per employee on BPO services in 2024; at a 3.12% CAGR, this amount is predicted to increase to US$3.43 billion by 2030. Organizations can reduce overhead, increase focus on key competencies, and adapt flexibly to market changes by outsourcing routine tasks such as finance, human resources, and customer service.

2. Digital Transformation and Automation

Switzerland is achieving significant productivity improvements driven by technology. Since 2020, approximately 80% of BPO companies have increased automation, adopted AI, and upgraded digital processes to modernize operations and enhance client satisfaction.

Approximately 46% of Swiss work hours can be automated using current technology, which exceeds global standards, according to a McKinsey report. By integrating RPA, AI, analytics, cloud, and low-code systems across functions, BPO companies are filling this gap.

3. Skilled Workforce Availability

KPMG reports that high-caliber expertise in the fields of finance, IT, compliance, and multilingual assistance is abundant in Switzerland. Every day, more than half of the workforce uses broadband to access digital work tools.

However, McKinsey cautions that by 2030, task automation may affect 1.0–1.2 million jobs, making workforce agility and BPO talent acquisition crucial in a labor market that is evolving.

4. Multilingual Capabilities

Swiss BPO companies serve both local and international clients with fluency in German, French, Italian, and English. With providers offering seamless linguistic and cultural integration, this multilingual strength enhances customer service, compliance management, and document processing across various industries, including BFSI, healthcare, and public services.

5. Growth in SMEs and Startups Outsourcing Non-Core Tasks

BPO is becoming increasingly popular among SMEs and startups for non-core functions such as marketing, bookkeeping, payroll, and chat support. RPA and low-code automation systems, which reduce human labor and enable scalability even in small teams, are gaining popularity among SMEs, according to KPMG.

Additionally, according to a study, up to 11% of office positions in Swiss SMEs may be automated using current technology, which would be a strong incentive to outsource repetitive activities.

Challenges Faced by Companies in the Swiss BPO Market

Despite high demand from sectors such as BFSI and healthcare, Switzerland’s BPO industry faces several structural and strategic obstacles that limit its scalability and competitiveness.

Among the most urgent issues are:

1. Data Privacy and Regulatory Constraints (e.g., GDPR, Swiss Data Protection Act)

With effect from September 2023, Swiss BPO providers are required to abide by the updated Federal Data Protection Act (FADP) and the EU’s GDPR. The FADP mandated rigorous data protection impact studies, privacy-by-design commitments, and more stringent breach notification standards.

Those held directly liable for data violations may be subject to fines of up to CHF 250,000 and potential legal action. These compliance requirements increase operating expenses, as they necessitate sophisticated data security infrastructure, legal advice, and internal audits, particularly in the public sector, private industry, and healthcare, where outsourcing is prevalent.

2. Language and Cultural Nuances

Due to Switzerland’s multilingual environment (German, French, Italian, and English), business process outsourcing (BPO) companies must provide services that are both linguistically accurate and culturally sensitive.

Trust can be damaged by a mismatch in tone, wording, or cultural background, particularly in highly regulated industries like public services or banking. According to public opinion expressed in local forums, “regional nuances can make or break client satisfaction.”

A significant investment in training and quality assurance systems is required to ensure consistent quality across languages.

3. High Labor Costs Compared to Offshore Locations

Swiss BPO labor expenses present a competitive hurdle because the country has one of the highest wage levels in Europe. 80% of Swiss IT and BPO projects are still outsourced, and 43% of them anticipate increasing their offshore investment, according to Whitelane Research.

Because of this, domestic providers are under pressure to compensate for cost differences by offering cutting-edge services, such as cloud platforms, AI integration, and specialized knowledge, that warrant a higher price than those offered by alternatives from elsewhere.

4. Resistance to Outsourcing in Some Sectors (e.g., Public Services)

Outsourcing in the Swiss public sector remains hindered by structural and political opposition, despite the Digital Switzerland Strategy 2026’s objectives to modernize administrative services.

Deeply ingrained organizational barriers are highlighted by the Deloitte Swiss Digital Government Survey, which shows that 38% of public service employees cited “rigid and complicated processes” as the main barrier to digital adoption, closely followed by 37% who cited general discomfort with digital tools.

Furthermore, the fragmented governance and finance arrangements created by Switzerland’s decentralized federal system, which comprises 26 cantons and more than 2,200 municipalities, complicate procurement procedures and hinder digital efforts. If coordination between these levels is not streamlined through clear political direction, progress may be considerably slowed.

Key Companies in the Swiss BPO Market

Switzerland’s BPO market brings together local champions, multinational giants, and nearshore specialists, each offering deep expertise in quality, innovation, and regulatory compliance:

- Avaloq: It is a prominent player in BPO with a fintech focus. It provides Swiss and foreign clients with integrated BPaaS and SaaS platforms for outsourcing core banking operations, compliance, and transaction processing.

- SPS (Swiss Post Solutions): As the outsourcing division of Swiss Post, SPS focuses on back-office systems, digital mailrooms, and document management, helping Swiss companies implement sophisticated automation and secure, compliant workflows.

- Callpoint AG and TELAG AG: Both TELAG and Callpoint, with their respective headquarters in Basel and Zurich, are established leaders in outsourcing multilingual call centers and customer support.

- Invensis Technologies: Invensis is a well-known BPO company that supports the Swiss market by offering customer service, IT support, and financial and accounting services.

Future Outlook for 2026

In 2026, the BPO sector in Switzerland is entering a pivotal era marked by the maturation of the digital economy, increased regulatory scrutiny, and rapid technological advancements. The market’s advantages in multilingualism, compliance, and specialized services carve out a premium niche in the global outsourcing landscape, despite labor prices remaining high.

1. Market Growth Projections

In line with general European BPO trends, the Swiss BPO industry is projected to grow at an average annual rate of 6.2% CAGR, reaching USD 3.4 billion by 2030. The primary growth driver will be demand from multinational corporations, fintech startups, and SMEs seeking outsourcing solutions that comply with GDPR.

Swiss businesses are streamlining their operations through the use of cloud-first strategies and AI-based automation, which is shifting the BPO industry away from basic call center services and toward high-value products, such as analytics, compliance support, and digital transformation consultancy.

2. Emerging Opportunities

These are some of the emerging opportunities in the Swiss BPO market:

- AI-Enabled BPO: Swiss BPO companies are leveraging AI to equip chatbots, predictive analytics, and robotic process automation (RPA) for industries such as legal, healthcare, and finance. AI enhances speed, reduces human error, and enables real-time client interaction, all of which are particularly beneficial in Switzerland’s bilingual environment. Businesses can partner with top BPO providers such as Invensis Technologies. Invensis provides specialized services in the areas of customer service, finance & accounting, IT, and human resources. They are dedicated to data security, compliance (GDPR and Swiss data protection), and operational excellence.

- ESG-Driven Services: Swiss companies are increasingly outsourcing supplier due diligence, carbon tracking, and ESG-related reporting as they comply with EU sustainability laws such as the Corporate Sustainability Reporting Directive (CSRD). For BPO companies that are aware of compliance, this creates a new service category.

- Vertical Specialization: There is a significant uptake of industry-specific BPO solutions in the legal services, pharmaceutical, and BFSI sectors. Providers with domain expertise are likely to expand more quickly, particularly in fields subject to EU or Swiss regulations.

3. Workforce Evolution

The BPO workforce in Switzerland is expected to become more multilingual and tech-savvy by 2026. 68% of Swiss citizens speak more than one language at least once a week, 21% routinely use three languages, and 6.4% speak four or more languages.

Due to this linguistic diversity, Swiss companies are well-positioned to cater to complex, multilingual markets throughout Europe.

Simultaneously, there is an increasing drive to provide workers with AI-ready and digital skills. The goal of reskilling programs in Swiss tech hotspots, such as Zurich and Geneva, is to prepare workers for hybrid jobs, where individuals perform strategic, compliance-sensitive, and customer experience-driven tasks while technology handles basic duties.

4. Threats and Risks to Future Growth

There are some significant obstacles despite these growth drivers:

- Data Sovereignty & Compliance: Businesses must contend with higher expenses and more complex technical requirements for data processing and offshore outsourcing, as the Swiss Federal Act on Data Protection (revDSG) took full effect in September 2023, overseen by the Federal Data Protection and Information Commissioner.

- Economic Uncertainty: SMEs already facing cost challenges may postpone outsourcing decisions due to a global recession or inflationary pressures.

- Talent Shortages: Although Switzerland boasts a highly trained population, there is a growing need for specialized tech jobs in cybersecurity and artificial intelligence (AI), which may be difficult to fill locally without significant immigration or upskilling expenditures.

- Opposition in the Public Sector: According to a Deloitte study, 38% of Swiss public managers point to antiquated practices and bureaucracy as barriers to outsourcing and digitization.

Government Regulations & Compliance Factors

Some of the strictest cybersecurity and data protection regulations in Europe apply to the BPO sector in Switzerland. Legal compliance and regulatory alignment are non-negotiable for BPO providers as digital services grow, particularly in the public, healthcare, and financial sectors.

The following are the main governing elements influencing operations in 2026:

The 2026 Digital Switzerland Strategy

The Federal Council’s Digital Switzerland Strategy 2026 underscores the government’s commitment to delivering safe, inclusive, and cutting-edge digital services across both the public and private sectors. It supports the following frameworks:

- BPO providers that utilize automation and machine learning must adhere to AI governance and ethical data usage principles.

- Interoperable digital infrastructures facilitate cooperation between public organizations and BPO companies.

- Boosting confidence in digital services is particularly important in fields such as innovative government platforms, digital identity (e-ID), and eHealth.

Although it requires strict adherence to local data rules and system transparency, the approach promotes collaboration between the state and tech-driven companies (Switzerland Digital, 2023).

GDPR and Swiss Federal Act on Data Protection (revDSG)

In September 2023, Switzerland’s revised Federal Act on Data Protection (FADP/revDSG) came into effect, aligning closely with the EU’s GDPR. When combined, these rules:

- Specify the procedures for gathering, storing, processing, and transferring personal data.

- Demand clear data processing goals, express consent, and data minimization from BPO providers.

- Limit cross-border transfers, particularly if BPO services are provided to offshore teams located outside of the EU/EEA or in nations that aren’t considered “adequate.”

Severe fines and damage to one’s reputation may result from noncompliance. Services like customer service, HR processing, finance, and healthcare BPO are all significantly impacted by these legal requirements.

Monitoring of Cybersecurity: FOITT & NCSC

The cybersecurity requirements for BPO contracts in Switzerland are guided by several national standards. The Federal Office of Information Technology, Systems, and Telecommunication (FOITT) sets security requirements for partners involved in public outsourcing, while the National Cyber Security Centre (NCSC) monitors online threats and defines standards to ensure strong cyber hygiene among service providers.

Key directives under these frameworks include anonymizing and encrypting sensitive information during both storage and transmission, maintaining compliance with NIST, ISO/IEC 27001, or Swiss-specific security standards, and ensuring rapid breach reporting, especially in sectors that handle critical infrastructure. For businesses managing private banking, healthcare, or government data, adherence to these rules is essential.

Regulations and Rewards in the Public Sector

Despite the Swiss government’s progress in digitalization, public-sector outsourcing remains tightly regulated. Projects are required to demonstrate strict data control, financial efficiency, and clear strategic value, and outsourcing agreements must be disclosed in line with transparency rules, particularly for cross-border contracts. Additionally, varying digital and procurement policies at the cantonal level can further complicate national BPO bids.

Nonetheless, there are also incentives and enablers driving progress. These include support for digital innovation to help municipalities implement new services, along with cloud adoption, infrastructure development programs, AI pilot projects, and e-government initiatives that create opportunities for BPO partnerships.

However, widespread opposition still exists in some places. According to a 2024 Deloitte study, bureaucracy and cultural resistance to outsourcing continue to be cited as major obstacles by 38% of public administrators.

Conclusion

Despite its modest size, Switzerland’s BPO market is expected to expand strategically in 2026, driven by vertical specialization, regulatory alignment, and digital innovation. The providers best positioned for long-term success are those that combine AI, compliance, ESG principles, and linguistic proficiency, whether working with SMEs or large corporate clients.

Despite ongoing cost challenges, Switzerland is poised to become a premier European BPO hub for the future, thanks to its talent pool and digital infrastructure, which offer a distinctively appealing value proposition.

FAQs

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Optimize your store in 2026 with the best WooCommerce order management plugins. Automate order tracking, inventory, and customer service for success.

January 21, 2026

|

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

February 2, 2026

|

Services We Provide

Industries We Serve

.webp)