Revenue Cycle Management

Revenue Cycle Management5 Key Medical Billing Reports You Need for Efficient Billing Management in 2026

Content

Medical billing reports play a crucial role in monitoring and managing the financial health of medical practice. These reports provide valuable insights into the practice's revenue, accounts receivable, claims processing, and overall financial performance. By regularly reviewing and analyzing these reports, healthcare providers can identify trends, spot potential issues, and make informed decisions to optimize revenue and improve operational efficiency. These reports can go a long way in managing their finances and ensuring sustainable growth.

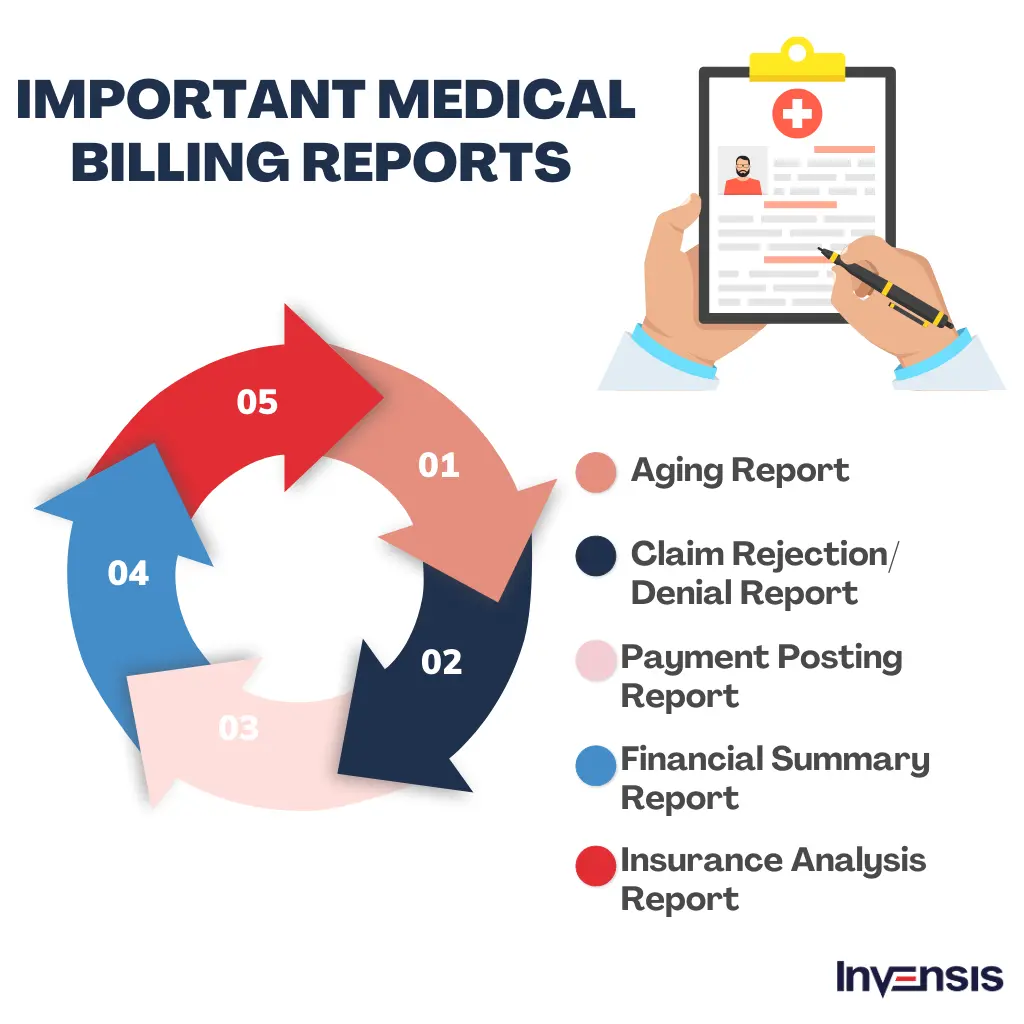

In this blog, we will delve into five important medical billing reports you should run to streamline your medical practice's efficiency in 2026.

Types of Important Medical Reports for Your Practices

The below-mentioned medical reports help healthcare providers identify areas of improvement, optimize their billing process, and make informed decisions to enhance financial performance:

1. Aging Report

The aging report is a financial report that categorizes outstanding accounts receivable based on the length of time invoices have been unpaid. It provides a snapshot of overdue payments, allowing healthcare providers to track outstanding balances, prioritize collections efforts, and manage cash flow effectively. It also helps identify potential cash flow issues, improve collections, and maintain a healthy revenue cycle for the medical practice.

The aging report categorizes outstanding accounts receivable based on payment timelines, typically in increments such as 30 days, 60 days, 90 days, and beyond. By organizing outstanding balances in this manner, healthcare providers can identify which payments are overdue and assess the aging of their accounts receivable. This categorization allows for a clearer understanding of which accounts require immediate attention, aiding in prioritizing collections efforts and optimizing cash flow management.

Medical practices should regularly review aging reports as they offer several benefits for managing collections and tracking overdue payments. It allows healthcare providers to identify delinquent accounts and take timely action to pursue payment.

2. Claims Rejection/Denial Report

A claim rejection/denial report in medical billing is a summary that identifies and explains reasons for insurance claim denials or rejections, detailing the necessary actions for resubmission or appeal. It provides detailed insights into claims that have been rejected or denied by insurance companies.

By analyzing this report, healthcare providers can pinpoint common issues causing rejections or denials, such as incorrect coding or missing documentation. This information helps them take corrective actions, such as improving coding accuracy or providing additional documentation, to resubmit the claims for reimbursement and optimize revenue generation.

Common reasons for claim rejections or denials include coding errors, missing or incomplete documentation, eligibility issues, and billing discrepancies. These rejections or denials can have a significant impact on a medical practice's revenue. When claims are not reimbursed, it can lead to delayed or reduced payments, affecting cash flow and profitability. By understanding the common reasons for rejections or denials, as well as KPIs for medical billing, healthcare providers can address these issues proactively, improve claim submission accuracy, and maximize revenue potential.

3. Payment Posting Report

A payment posting report in medical billing is a document that records and reconciles the payments received from insurance companies or patients. It provides a clear overview of the processed payments and any outstanding balances for services rendered. The report allows healthcare providers to track and reconcile payments, ensuring accuracy in financial transactions.

Payment posting report also helps identify any discrepancies between payments and associated claims, such as underpayments or overpayments. By reviewing the payment posting report, providers can ensure timely and accurate posting, identify and resolve any payment-related issues, and maintain the integrity of their financial records.

The payment posting report even plays a crucial role in ensuring the accurate and timely posting of payments in medical billing. By comparing payments received to associated claims, healthcare providers can verify the correct allocation of payments to specific patient accounts. This process helps identify any discrepancies or errors in payment posting, ensuring accurate financial records. Timely review of the report enables prompt resolution of any posting issues, allowing for efficient reconciliation and preventing delays in revenue recognition.

4. Financial Summary Report

A financial summary report in medical billing is a concise overview of financial transactions related to the services provided by healthcare practices. It consolidates key financial data, such as total charges, collections, adjustments, and outstanding balances, into a single report. The report allows healthcare providers to assess revenue generation, track cash flow, and analyze the overall financial health of the practice.

By reviewing the financial summary report, providers can identify trends and compare performance against benchmarks or targets. These things help them make informed decisions to optimize financial performance, allocate resources effectively, and ensure the sustainability of the practice.

The financial summary report also plays a crucial role in analyzing revenue generation and identifying trends for informed financial decision-making in medical practice. By examining the report, healthcare providers can assess the sources and patterns of revenue, allowing them to identify the most profitable services, payers, or patient demographics. Moreover, it allows providers to compare current performance with previous periods or industry benchmarks, enabling them to assess the success of financial decisions and make necessary adjustments.

5. Insurance Analysis Report

An insurance analysis report in medical billing is a comprehensive assessment that evaluates the coverage and reimbursement patterns of different insurance providers. It offers key insights into the revenue generated by different insurance payers. Insurance analysis reports help healthcare providers assess the financial performance of insurance contracts and identify opportunities for optimization.

By analyzing the report, providers can evaluate the profitability of different payers, identify underperforming contracts, negotiate favorable reimbursement rates, and make strategic decisions regarding payer mix and contracting to maximize revenue and improve overall financial viability.

This comprehensive assessment examines the coverage and reimbursement patterns of various insurance providers, shedding light on potential payment issues and opportunities for improvement. By meticulously reviewing claim denials and rejections, the report identifies recurring patterns, enabling providers to rectify coding errors, missing information, or other issues that hinder payment processing. Additionally, the report helps healthcare facilities evaluate the effectiveness of their contracts with different insurance companies, ensuring they receive fair reimbursement rates for the services provided.

Conclusion

Medical billing reports will continue to be of paramount significance in the future as they play a pivotal role in driving advancements in healthcare. However, staying on top of medical report generation can be challenging for several reasons. Firstly, the sheer volume of data generated in healthcare practices can be overwhelming, requiring dedicated resources and efficient systems to collect, process, and analyze the information.

Additionally, medical reports often require collaboration between various departments, such as billing, coding, and clinical teams, which can introduce coordination challenges. Moreover, evolving regulatory requirements and coding guidelines necessitate ongoing training and education to ensure accurate and compliant report generation. Furthermore, technological limitations, such as outdated or incompatible systems, can hinder the efficient generation and utilization of medical reports. Overcoming these challenges requires investment in infrastructure, streamlined workflows, and continuous training to maximize the benefits of medical reports.

We at Invensis help healthcare practices stay ahead of competitors by generating detailed and easy-to-understand reports on our medical billing services. Our experts provide a complete and accurate picture for decision-making by consolidating and analyzing crucial data points from different data sources. We also provide a holistic understanding of a practice's strengths and weaknesses and empower their decision-making ability for better financial sustainability. Partner with us now to know more about our services.

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Optimize your store in 2026 with the best WooCommerce order management plugins. Automate order tracking, inventory, and customer service for success.

January 21, 2026

|

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

January 19, 2026

|

Services We Provide

Industries We Serve

.webp)