Revenue Cycle Management

Revenue Cycle ManagementA Step-by-Step Guide to Mastering the 13 Steps of Revenue Cycle Management in Healthcare

Content

The success of a healthcare practice hinges on its ability to master the art of Revenue Cycle Management (RCM). RCM serves as the vital circulatory system that keeps the financial health of healthcare organizations thriving.

RCM in medical billing encompasses a complex series of steps, from patient registration and appointment scheduling to insurance verification, claims processing, and reimbursement. While the concept of RCM is well-known, achieving excellence in its execution has remained elusive for many healthcare providers.

There are many pitfalls at every turn of these important steps in revenue cycle management, each of which can disrupt the smooth flow of revenue. Billing errors, claim denials, and delayed reimbursements can create financial strain and hinder the overall operations of a healthcare practice.

This blog will unravel the vital 13 steps of the revenue cycle management process and explore the significance of each step in ensuring the financial stability of healthcare practices.

Proven 13 Steps of Revenue Cycle Management for Optimization

The following sections comprehensively discuss the 13 most significant steps of healthcare revenue management.

1. Patient Pre-registration

Patient pre-registration is the first step in the healthcare revenue cycle management process. At its core, this process involves collecting crucial patient data and verifying their insurance eligibility well in advance of any scheduled medical services. By doing so, healthcare providers lay the foundation for a streamlined and efficient revenue cycle.

Accurate and complete information gathered during pre-registration ensures that subsequent billing and reimbursement processes are conducted with precision, reducing administrative errors and minimizing the risk of denied claims while also enhancing patient satisfaction through a more seamless registration experience.

2. Insurance Verification

Insurance verification in the revenue cycle management journey confirms a patient's insurance coverage and benefits. The verification process also ensures that healthcare services are correctly billed and reimbursed.

In-depth insurance verification prevents claim denials and accelerates revenue flow. In addition, it aids in estimating patient responsibility and enhancing financial transparency. Robust insurance verification processes are essential for optimizing revenue cycles while delivering cost-effective healthcare services.

3. Patient Registration

Patient registration is the bridge between initial contact and healthcare delivery and serves as a critical juncture in revenue cycle management in medical billing. During this stage, healthcare providers gather comprehensive patient information, medical history, and consent forms.

Accurate registration ensures proper identification, reduces billing errors, and promotes efficient claims processing. It's a vital component in delivering quality care and maintaining a robust revenue cycle, as this registration process establishes the patient-provider relationship and lays the groundwork for accurate billing and reimbursement.

4. Charge Capture

Charge capture is another critical phase in the revenue cycle process flow, where healthcare providers record and document the services, procedures, and supplies provided to patients.

Efficient charge capture ensures that all billable services are accounted for, leading to appropriate billing and reimbursement. This step helps maximize revenue and maintains compliance with regulatory requirements. Effective charge capture contributes to financial health, transparency, and the overall success of healthcare organizations.

5. Claim Submission

Claim submission is an important step in RCM, wherein healthcare providers compile and send claims to insurance payers for reimbursement. This process demands precision, as errors or omissions can lead to claim denials and delayed payments.

Effective claim submission involves accurate coding, thorough documentation, and adherence to payer-specific guidelines. Streamlining this step is essential to ensure timely reimbursement and maintain the financial stability of healthcare organizations.

6. Claim Adjudication

Claim adjudication is a vital process where insurance payers assess and make determinations regarding submitted claims. During this stage, payers review claims for accuracy, completeness, and compliance with policy terms. They then decide on payment or denial and the amount to be reimbursed.

Timely and accurate claim adjudication is vital for healthcare providers to receive the revenue they are entitled to, ensuring financial stability and enabling them to continue delivering quality care.

7. Payment Posting

Payment posting is a major step in which payments received from insurance companies, patients, and third-party payers are recorded and applied to patient accounts. This process demands precision to ensure accurate tracking of payments, adjustments, and patient balances.

Efficient payment posting not only minimizes errors but also aids in revenue reconciliation and financial reporting. It is instrumental in maintaining a clear financial picture and optimizing the revenue cycle.

8. Denial Management

Denial management is another critical component of the healthcare revenue cycle management process, as it focuses on identifying, analyzing, and resolving denied insurance claims. Denied claims can lead to significant revenue loss if not addressed promptly and effectively. This stage involves investigating the reasons for denials, correcting errors, and resubmitting claims to ensure reimbursement.

A robust denial management process not only improves revenue but also provides insights into areas where operational improvements can reduce future denials and enhance financial performance.

9. Accounts Receivable Follow-up

Accounts receivable follow-up in revenue cycle management involves the monitoring and pursuit of outstanding payments from insurance companies, patients, and third-party payers.

Timely and effective follow-up helps healthcare organizations reduce aging accounts receivable, accelerate cash flow, and minimize bad debt. It requires consistent communication with payers and patients to resolve outstanding claims and balances and ensure a healthy financial foundation for healthcare providers.

10. Patient Statement Processing

Accounts receivable follow-up in revenue cycle management involves monitoring and pursuing outstanding payments from insurance companies, patients, and third-party payers.

Patient statement processing is instrumental in enhancing transparency and patient engagement, as it empowers individuals to understand their healthcare expenses. By facilitating clear and timely communication of financial information, healthcare providers not only foster patient trust but also streamline revenue collection processes for sustained financial health.

11. Patient Payment Collection

Patient payment collection is a vital part of healthcare revenue cycle management. The process focuses on securing payments from patients for their portion of medical expenses and includes steps such as educating patients about their financial responsibilities, offering flexible payment options, and efficiently securing payments.

Effective patient payment collection is essential for improving cash flow and ensuring the financial viability of healthcare organizations. Moreover, it promotes patient satisfaction by providing transparent billing processes and accommodating diverse financial circumstances, creating a win-win situation for providers and patients.

12. Revenue Analysis and Reporting

Revenue analysis and reporting are fundamental to efficient healthcare revenue cycle management. This critical phase involves the systematic examination of financial data to gain insights into the financial performance and overall health of a healthcare organization.

By scrutinizing revenue trends, identifying areas of improvement, and benchmarking against industry standards, healthcare providers can make informed decisions to optimize revenue streams and enhance operational efficiency. On the other hand, robust reporting ensures transparency and compliance and empowers organizations to formulate strategic plans for long-term financial stability and growth.

13. Compliance and Auditing

Compliance and auditing are crucial in revenue cycle management. These processes involve rigorous adherence to legal and regulatory requirements and internal policies and procedures. By conducting regular audits, healthcare organizations can ensure that their revenue cycle operations remain compliant and efficient.

Auditing identifies potential areas of risk, helps mitigate fraud and billing errors, and maintains financial integrity. Compliance and auditing also serve as the guardians of financial and ethical standards within the healthcare revenue cycle.

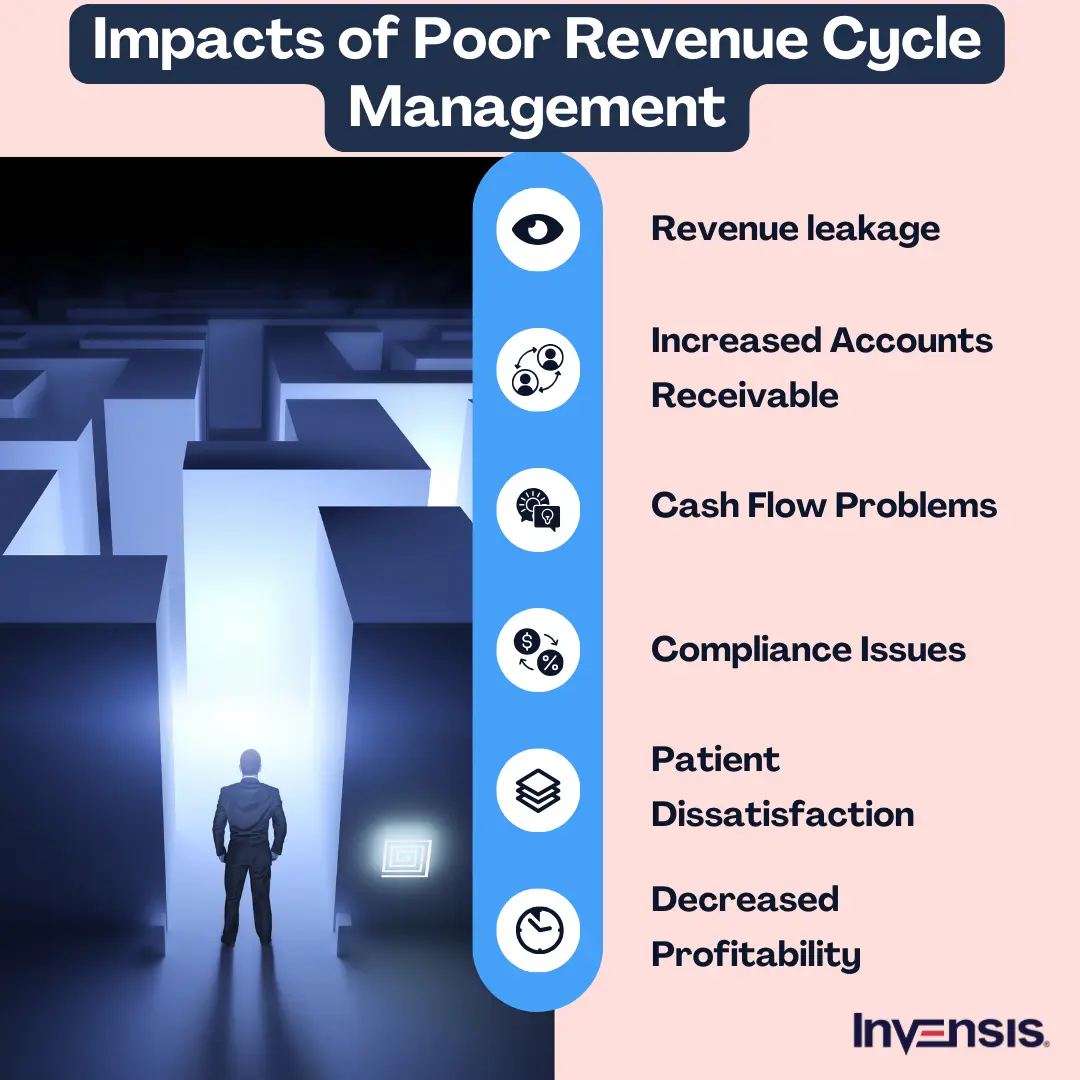

Common Challenges in the RCM Process

Several common challenges can arise in the RCM cycle steps, and addressing them is essential for the financial health of healthcare providers. Here are some of the common challenges:

1. Denials and Rejections

Denials and rejections in the revenue cycle management process are common challenges where healthcare claims are either refused or sent back due to errors or discrepancies. These issues can lead to delayed payments, revenue loss, and increased administrative burdens for healthcare providers. Addressing and reducing denials is crucial for financial stability in healthcare organizations.

2. Billing Errors

Billing errors represent a significant challenge in RCM. These errors can encompass inaccuracies, such as incorrect codes, incomplete documentation, or mismatched patient information. Billing errors can result in delayed payments, claim denials, and compliance issues, making accurate billing practices essential for financial success in healthcare.

3. Compliance and Regulatory Changes

Compliance and regulatory changes pose a continuous challenge in revenue cycle management. Healthcare organizations must stay updated with evolving laws and regulations, such as HIPAA and ICD-10 coding updates. Non-compliance can lead to penalties, legal issues, and revenue loss, necessitating ongoing vigilance and adaptation to maintain RCM effectiveness.

4. Data Entry and Accuracy

Data entry and accuracy are pivotal in RCM. Even minor errors in patient information, coding, or billing details can lead to claim denials, payment delays, and significant financial losses for healthcare providers. Accurate data entry processes, diligent validation, and regular audits are essential to maintain data accuracy and streamline the RCM workflow. By prioritizing data precision, healthcare organizations can enhance revenue collection efficiency and reduce the risk of compliance issues and financial setbacks.

5. Patient Eligibility Verification

Ensuring that patients have valid insurance coverage and that their policies are up-to-date is essential to avoid claim denials and billing issues. Inaccurate eligibility checks can lead to payment delays and increased administrative burdens. Healthcare providers must implement robust verification processes to confirm patient insurance details and minimize RCM challenges related to eligibility discrepancies.

6. Delayed Payments and Cash Flow Issues

Delayed payments can significantly impact the cash flow of healthcare providers, creating financial instability. Payment delays may result from slow processing by insurers, discrepancies in claims, or administrative backlogs. Providers need to streamline their billing and collection processes to improve cash flow and reduce the time between service delivery and payment receipt. Implementing efficient follow-up procedures and effective communication with payers can help address this challenge.

7. Inefficient Claims Management

Inefficient claims management is another common issue in the RCM process. Claims can be lost, delayed, or incorrectly processed if the system is not well-organized. This inefficiency can result in missed revenue opportunities, increased administrative costs, and the risk of legal issues. By automating claims submission, tracking claims in real-time, and maintaining proper follow-up procedures, healthcare organizations can mitigate this challenge and enhance revenue cycle efficiency.

8. Staffing and Resource Limitations

Limited staffing and resources can impede the effectiveness of RCM. Inadequate staff training, high employee turnover, and an overstretched workforce can lead to errors in coding, billing, and claims follow-up. Healthcare providers must invest in staff training, optimize workloads, and explore technology solutions to support their RCM teams, ensuring they have the resources to manage the revenue cycle efficiently and effectively.

How to Optimize Revenue Cycle Management Process

Here are steps to optimize the RCM process in healthcare:

- Streamline Patient Registration: Improve data accuracy during registration to reduce claim denials and billing errors, ensuring timely reimbursement.

- Efficient Coding and Documentation: Implement coding best practices to maximize claim accuracy and minimize compliance risks.

- Automated Claims Submission: Utilize electronic claims submission for faster processing and reduced administrative costs.

- Timely Claims Follow-Up: Establish a systematic process for tracking and resolving unpaid claims to reduce revenue leakage.

- Patient Payment Solutions: Offer convenient payment options and financial counseling to improve patient collections.

- Performance Analytics: Regularly analyze key performance indicators to identify bottlenecks and implement continuous process improvements.

How to Monitor the Key Metrics of the RCM Process

Monitoring the key metrics of a Revenue Cycle Management (RCM) process is crucial for healthcare organizations to ensure financial health and operational efficiency. Here's how you can monitor the key metrics of an RCM process effectively:

- Claim Submission Rate: Track the percentage of claims submitted on time to ensure timely revenue capture and minimize denials, aiming for a high submission rate.

- Days in Accounts Receivable (AR): Monitor the average time it takes to collect payments, aiming for a low number to maintain cash flow and reduce financial risk.

- Denial Rate: Keep an eye on the percentage of claims denied and work on reducing it by addressing root causes to maximize revenue.

- Average Reimbursement Rate: Calculate the average payment received per claim to ensure contracts with payers are being honored and negotiated effectively.

- Collections Rate: Measure the rate at which outstanding balances are collected, aiming for a high collections rate to improve cash flow and reduce bad debt.

- First-Pass Resolution Rate: Assess how often claims are processed successfully on the first submission to minimize rework and accelerate revenue realization.

- Net Collection Rate: Calculate the percentage of billed charges that are collected, accounting for adjustments and contractual write-offs, to evaluate overall revenue performance.

Conclusion

The future of RCM is promising, driven by rapid technological advancements. Artificial intelligence, data analytics, and automation are transforming how revenue cycles are managed, making processes faster, more accurate, and less prone to errors. Enhanced data security measures are also essential to protect sensitive patient information in this digital era.

However, the evolving landscape of RCM brings challenges, such as staying compliant with ever-changing regulations and managing the intricacies of data privacy. These hurdles necessitate a proactive approach and constant adaptation.

Partnering with a third-party service provider has emerged as a strategic solution for many organizations. Invensis is a reputed third-party provider specializing in revenue cycle management services. We have developed standardized procedures and protocols to ensure consistent and efficient execution of our services. These procedures incorporate the latest advancements in technology and industry best practices.

Contact us today for tailored RCM solutions to enhance your revenue cycle and ensure compliance with industry standards!

Frequently Asked Questions

Discover Our Full Range of Services

Click HereExplore the Industries We Serve

Click HereBlog Category

Related Articles

Optimize your store in 2026 with the best WooCommerce order management plugins. Automate order tracking, inventory, and customer service for success.

January 21, 2026

|

Find the leading accounting firms in Singapore trusted by businesses for audit, tax, and advisory services.

November 6, 2025

|

Explore the leading accounting firms in South Africa providing expert audit, tax, cloud accounting, and payroll services. Learn about their key features and unique offerings.

January 19, 2026

|

Services We Provide

Industries We Serve

.webp)